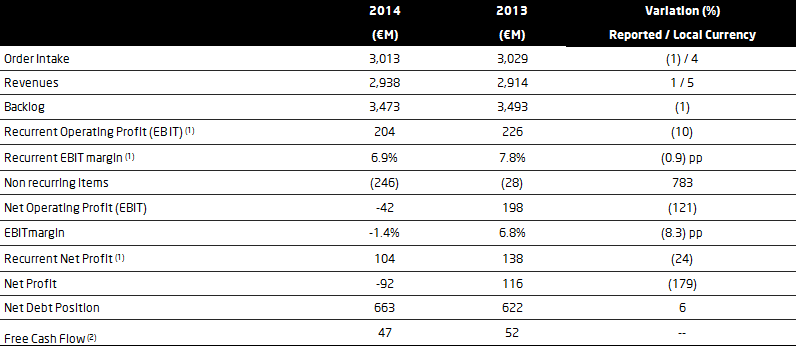

- Revenue in local currency terms grew in all vertical markets, while the order backlog expanded to €3,473 million, with order intake in AMEA and Latam showing double-digit growth

- Recurring operating margin stood at 6.9% and free cash flow generation at €47 million

- Net profit stood at -€92 million as a result of provisions, impairments and non-recurring items due to changes in estimates, totaling a gross €313 million, in projects, intangible assets, goodwill and tax credits

- The company will host an Investor's Day in late June to discuss the company's strategy, operating plans and offer medium-term financial indications

Total Indra revenue in 2014 stood at €2,938 million, representing 5% growth in local currency terms and 1% in the reported numbers (in euro).

By regions, the performance in Latin America stood out, with growth of 10% in local currency terms, as did European and North America, with an uptick of 7% in local currency. Spain (representing 39% of the total) showed a flat performance after four years of declines.

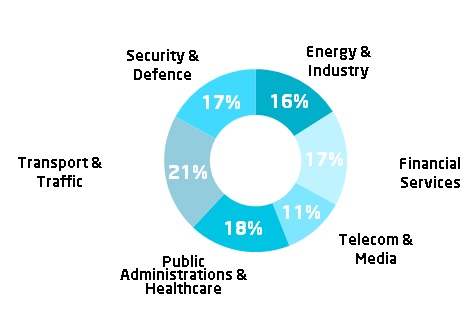

In local currency terms, all vertical markets recorded growth: Financial Services up 9%; Public Administrations & Healthcare 7%; Transport and Traffic 5%; Security and Defense 3%, Energy and Industry 3%; Telecommunications and Media 2%.

Order intake grew 4% in local currency terms and there was double-digit growth in Latin America and AMEA in local currency terms, and also in the vertical markets of Transport & Traffic, Financial Services and Public Administrations & Healthcare. This increase in order intake drove the order backlog to €3,473 million (+3% in local currency), equivalent to 1.2 times revenue for the last twelve months.

The recurring EBIT margin stood at 6.9%, while net profit before the aforementioned non-recurring effects would have been €104 million.

Indra's business performance in 2014 was shaped by: a deteriorating macroeconomic climate for raw material exporting economies, the devaluation of Latin American currencies and prices coming under pressure, combined with increased implementation costs for certain projects. These factors were felt more acutely in the last quarter of the year.

Following an extensive review, during the fourth quarter non-recurring items have been registered due to delays, reschedules and cancelation of programs, as well as changes in estimates, intangibles goodwill and tax credits impairments that were particularly affected by the aforementioned business trends. Said non-recurring effects totaled a gross €313 million before taxes, with a total impact on attributable profit of €196 million.

The main non-recurring effects are as follows: €231 million due to provisions, impairments and overcosts in projects due to delays, reschedules and cancelation of programs, as well as changes in estimates as a result of events or litigious situations concurred in the last part of 2014 and beginning of 2015; €19 million due to intangible asset impairments, after annual tests indicated a slower business recovery than anticipated for certain investments; €21 million due to the goodwill impairment test, which recommended reducing goodwill for Brazil by €17 million and for Indra Business Consulting by €4 million; €19 due to tax credit impairment in Brazil; and €17 million linked to the efficiency adjustment and resource optimization plan.

With these negative effects factored in, net profit for the year stood at -€92 million.

Free cash flow generation was up to €47 million from €27 million in 2013 in like-for-like terms, short of the target for the year.

Net debt stood at €663 million compared to €622 million at year-end 2013, representing leverage of 2.5 times EBITDA.

At the end of June, Indra will host an Investor’s Day for investors and analysts to outline its strategic lines, operating plans and medium term financial indications.

REVENUES BY MARKET

MAIN FIGURES

(1) Before non recurring items

(2) 2013 FCF adjusted for the impact of the disposal of the business of advanced management of digital documentation were €27M