- The company reasserts all the financial targets set for 2025

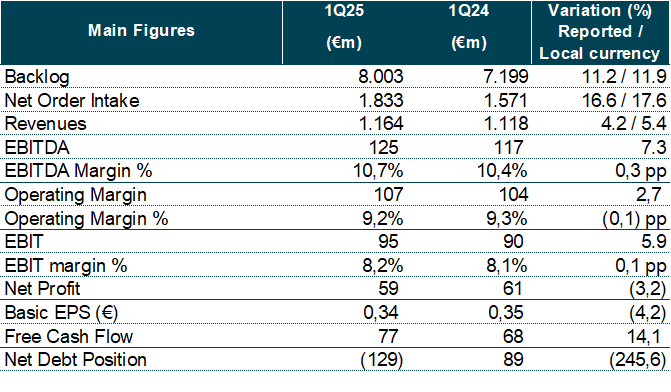

- The backlog exceeded the figure of €8 billion at the end of March 2025, showing 11% growth, while the order intake increased by 17%

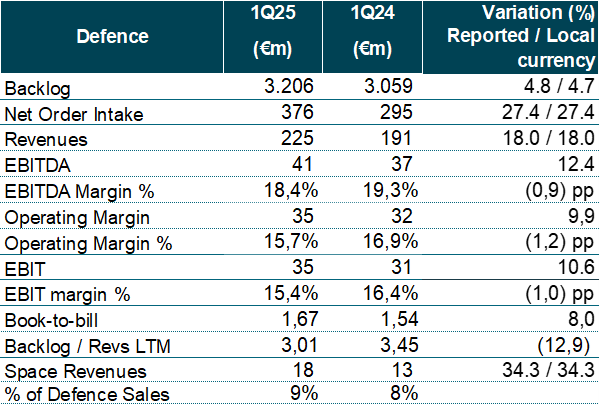

- Defence procurement is expected to double in 2025 compared to 2024

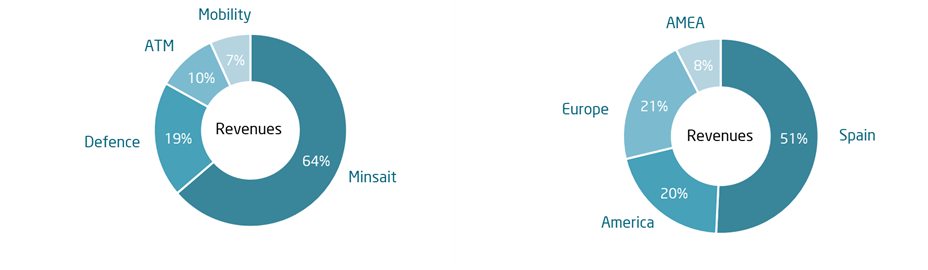

- Revenues grew by 4% in the quarter compared to the same period in 2024, with an 18% year-on-year increase in the contribution of Defence and the 7% growth of Minsait, without the Elections business and the exchange rate effect

- EBITDA and EBIT recorded respective 7% and 6% year-on-year rises, with slight improvements in the two margins

- The cash generation (FCF) totaled €77 million in the quarter, compared to the figure of €68 million recorded in the first three months of 2024

Ángel Escribano, the Executive Chairman of Indra Group, underlined that “we’re continuing to fulfill and expand our objectives, and we’ve reached a moment of great ambition and projection for the future. The combination of our capabilities as a technological group will allow us to stand at the forefront of the new era of digitalization in strategic areas such as the aerospace industry, defence and the civil sector. We’d like to be a productive company with autonomy when it comes to manufacturing and commissioning our products and systems. This approach, together with our growth, in organic terms and in partnership with other companies alike, will enable us to become a key partner to become an indispensable partner in Spain's technological planning and development, and to be able to compete on a large scale in the global arena”.

As for Indra Group CEO José Vicente de los Mozos, he expressed his satisfaction with the development of the Leading the Future Strategic Plan and the objectives that the group is achieving as a corporation under this roadmap. “We’re consolidating profitable and sustained growth, with results that not only reflect the company’s strong performance, but also lay solid foundations to ensure that we meet our targets for 2026. In fact, we expect to reach our goal of €10 billion in turnover ahead of schedule, as we initially expected to do so by 2030. With the scaling in key sectors, the launch of recent proposals such as IndraMind and the incorporation of the best technological talent, we’re in a position to capitalize on the full potential we have as a nation in the most important areas of development”.

Most significant figures in the quarter

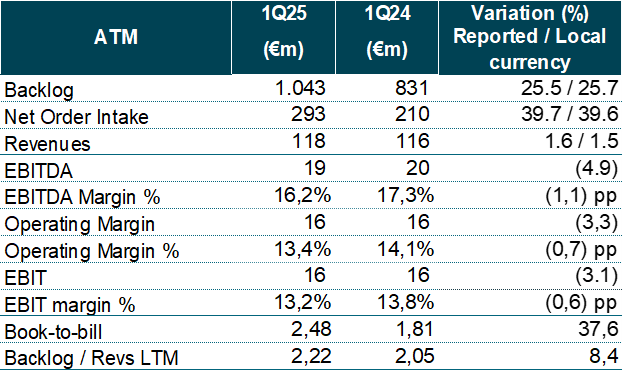

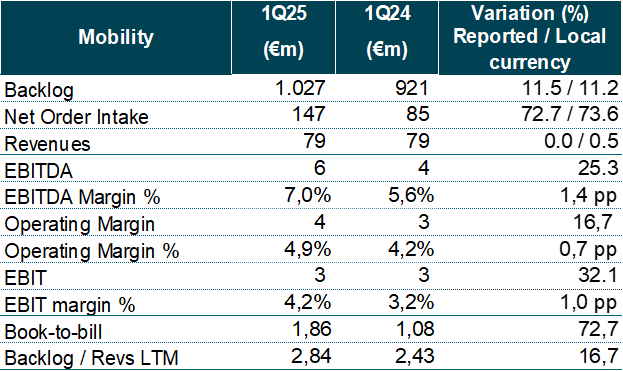

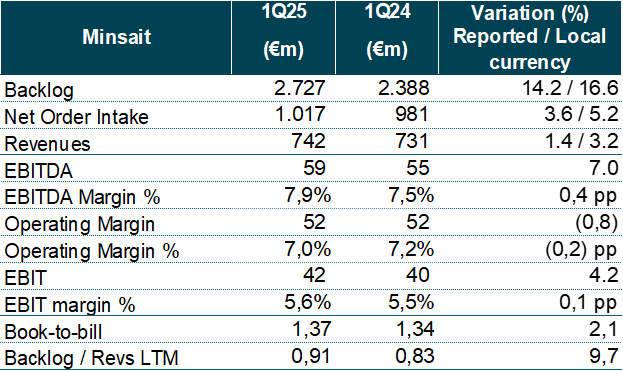

Revenues in the first quarter of 2025 grew by 4%, with all of Indra Group’s divisions reporting growth (18% in Defence, 2% in ATM and 1% in Minsait), with the exception of Mobility, which remained stable. The comparative revenue growth in the period with respect to the first quarter of 2024 was affected by the lower one-off contribution of the Elections business in the period (€9 million versus €36 million). Without the Elections business, total revenues would have grown by 7%, while Minsait revenues would have increased by 5%, both in reported terms.

The exchange rate deducted €13 million from revenues (-1.2 pp), mainly due to the depreciation of the currencies of Brazil, Mexico and Colombia.

Organic revenues in these three months (excluding the inorganic contribution of acquisitions and the effect of the exchange rate) rose by 3%, with increases in Defence (15%), Minsait (1%) and ATM (0.2%).

By geographical areas, the activity was concentrated in Spain (with 51% of the sales) and the Americas (20%). Specifically, revenues grew in Europe (by 12%; 21% of total sales), the Americas (by 4%; 20% of sales) and Spain (by 7%; 51% of total sales), while they declined in AMEA (a 23% fall; 8% of sales).

Ordinary Revenues increased by 4% during this period.

Other Revenues stood at €35 million compared to €19 million in the first quarter of 2024, mainly due to the higher level of subsidies and work on fixed assets.

The backlog continues to grow

The backlog in the first quarter of 2025 totaled €8.003 billion, up 11% compared to the same period of the previous year, driven by Minsait and ATM. The ratio between the backlog and sales in the last twelve months stood at 1.64x, set against the figure of 1.58x in the same months of 2024.

The net order intake increased by 17%, with sharp growth in all of the divisions, especially in Mobility, thanks to the contracts in Ireland and Colombia, in ATM, particularly in the United Kingdom (air navigation radars) and Spain, and in Defence, due to the radar contracts in Germany and the F110 frigates (United States). The procurement book-to-bill sales ratio stood at 1.57x, set against the figure of 1.41x in the first quarter of 2024.

Other major variables

The EBITDA margin stood at 10.7% in the first three months of 2025, compared to 10.4% in the same period of the previous year, with an increase of 7% in absolute terms. This rise can mainly be put down to the greater growth in revenues recorded in the division with the greatest operating profitability (Defence), as well as the improved returns of Mobility and Minsait.

The Operating Margin stood at 9.2%, compared to the figure of 9.3% in the first quarter of 2024, with 3% growth in absolute terms. Other operating income and expenses (the difference between the Operating Margin and the EBIT) amounted to -€12 million versus -€14 million in the same quarter of the preceding year, with the following breakdown: -€4 million workforce restructuring costs versus -€7 million; a -€5 million PPA (Purchase Price Allocation) impact on the amortization of intangibles versus -€4 million; and the -€3 million provision for stock-based compensation of the medium-term incentive, the same figure as in the previous year.

The EBIT stood at €95 million compared to €90 million in the same period of 2024, representing a 6% rise. Without the Elections business, the EBIT would have risen by 21%. The EBIT margin totaled 8.2% over the three months, compared to the figure of 8.1% in the same period of 2024.

The Net Income stood at €59 million compared to the figure of €61 million in the first quarter of 2024, constituting a 3% decrease, mainly as a result of the higher financial expenses and taxes.

The Free Cash Flow in the first period of 2025 totaled €77 million compared to €68 million in the same quarter of the previous year, thanks to the improved variation of the Working Capital and despite the higher Capex.

Finally, with respect to the Net Debt, the group ended March 2025 with a positive Net Cash position amounting to €129 million, compared to the figure of €86 million in December 2024, and set against the Net Debt of €89 million in March 2024. The Net Debt/LTM EBITDA ratio (excluding the IFRS 16 impact) stood at -0.2x in this quarter, compared to -0.2x in December 2024 and 0.2x in March 2024.

Goals for 2025*

- Revenues in local currency: greater than €5.2 billion

- Reported EBIT: greater than €490 million.

- Reported Free Cash Flow: greater than €300 million.

*Does not include the acquisitions of TESS Defence and Hispasat

Key Highlights

Acquisitions contributed €29 million to sales in 1T25 vs €3 million in 1T24. The acquisitions of Totalnet and MQA contributed inorganically to Minsait; GTA, Deimos and CLUE contributed to Defence, Micronav and Global ATS contributed to ATM; and Deimos contributed to Mobility.

Revenues by divisions and geographial areas