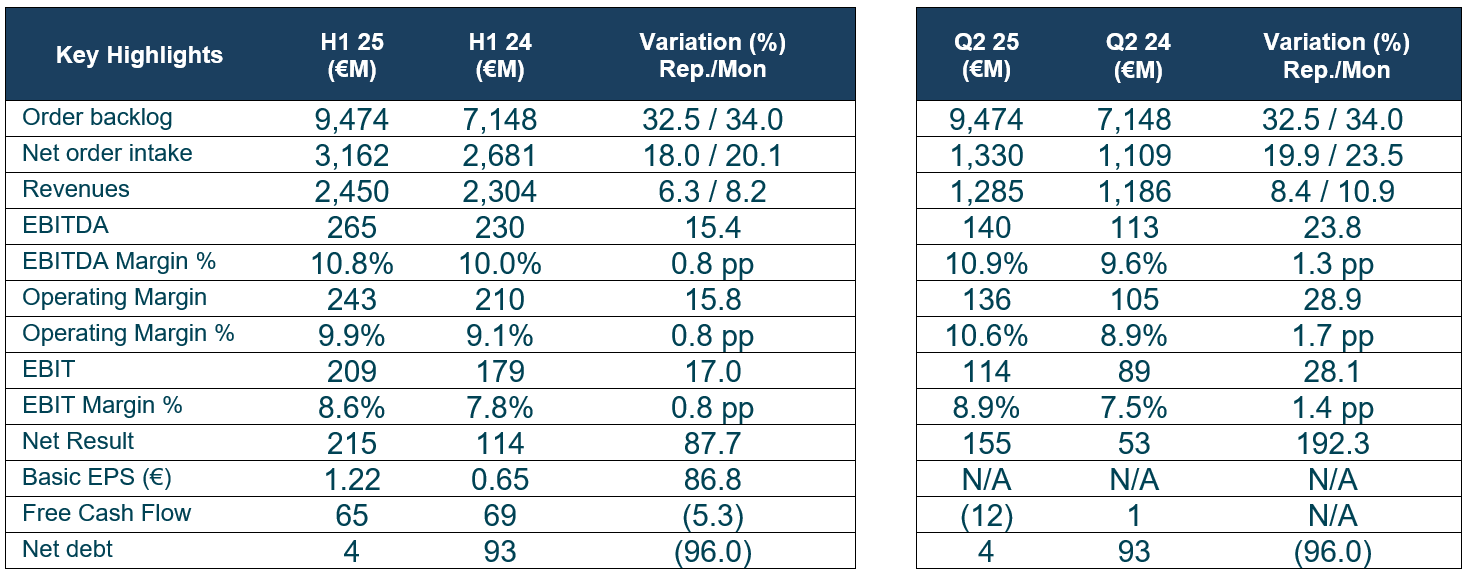

- The order backlog in the first six months of the year reaches €9.474 billion for the first time, constituting a 33% year-on-year increase with respect to the same period in 2024. This figure includes €1.449 billion stemming from the acquisition of TESS Defence.

- The order intake increased by 18% with respect to the first half of 2024, supported by the Defence, Air Traffic (ATM) and Mobility businesses, which record growth above 38% during the period.

- Revenues increased by 6% in the first six months of the year, with double-digit year-on-year rises in Defence and ATM.

- The EBITDA and EBIT, the indicators of operating profitability, increased by 15% and 17% year-on-year between January and June respectively.

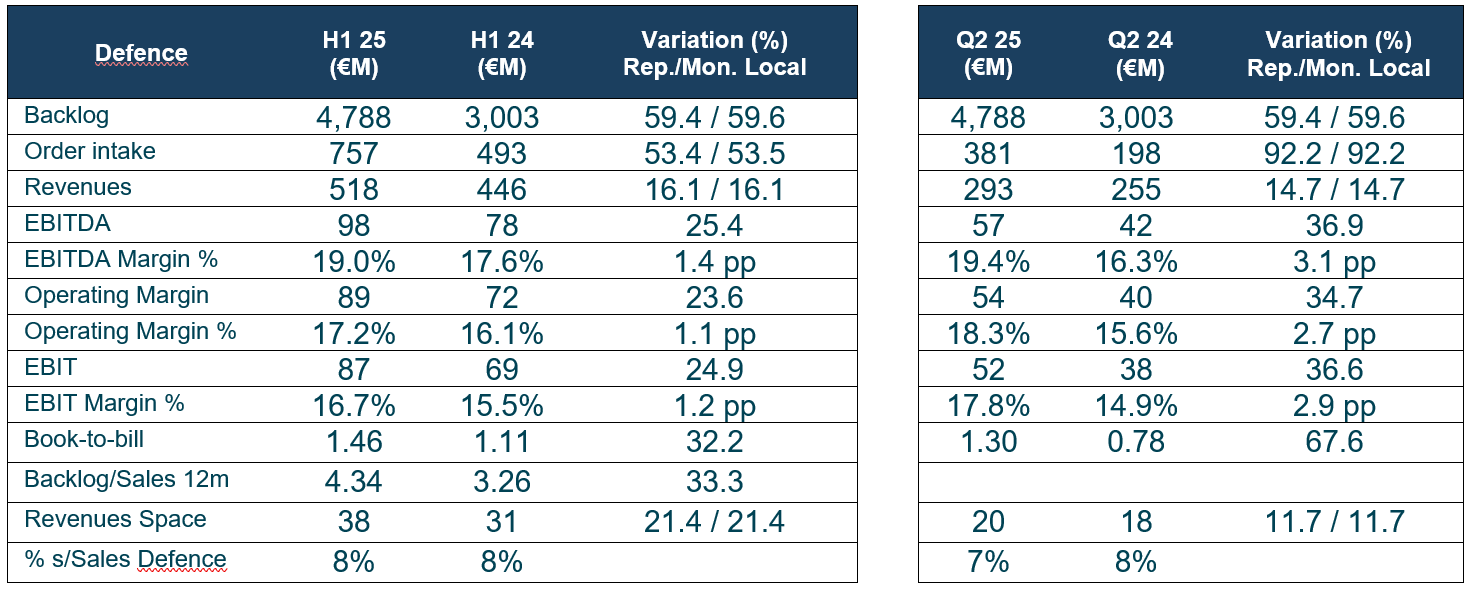

- The Defence and ATM divisions jointly account for more than half of the company’s EBITDA.

- The net profit totals €215 million in the first half of the year, constituting an 88% year-on-year increase. This figure includes the one-off impact of the financial results of TESS Defence.

- The number of employees grew by 3,542 in the period, a 6% increase with respect to the same period in 2024. Three out of every four new recruitments were in Spain.

- In June, the acquisition of a 26% stake in TESS Defence, the armored vehicle manufacturer, was completed, and the purchase of a 37% stake in the SPARC microchip startup was announced.

- The company strengthened all of its financial targets set for 2025

Ángel Escribano, executive chairman of Indra Group, emphasized that “the results in the first half of 2025 reflect how the company is harnessing business opportunities, accelerating projects, and growing in terms of its ambition. Besides, these accounts will enable us to move forward and foster the Spanish industrial ecosystem in the defence, space, and advanced technology sectors. The solidity of our strategy will allow Indra Group to position itself at a complex and changing moment in time that requires us to adapt and acquire proprietary capabilities and solutions to guarantee our strategic autonomy within the country and throughout Europe”.

As for Indra Group CEO José Vicente de los Mozos, he declared that “now that we’ve reached the halfway point of our Strategic Plan, we can reaffirm our undertaking to exceed all of the goals we’ve set for 2026. We’re speeding up the deployment of our industrial plan, with the aim of reducing deadlines and guaranteeing deliveries as we move towards the strategic autonomy of Spain and Europe. At the same time, we’ve deployed a new organizational model that will allow us to accelerate our innovation, reinforce our presence in the key markets, and mainstream our technological capabilities, develop our industrial capabilities, while simultaneously promoting the growth of our internal talent”.

Main features

Major rises in defence, mobility and ATM order intakes

The order backlog in the first half of 2025 exceeded €9 billion for the first time, standing at €9.474 billion, which constitutes a 33% rise with respect to the same period of 2024. €1.449 billion of this amount corresponds to the consolidation of TESS Defence. If we exclude this impact, the backlog would have increased by 12% compared to the figure recorded in the first half of 2024, driven by the double-digit growth recorded across all of the divisions.

The net order intake in the first half of 2025 increased by 18%, with significant growth across all of the businesses, including:

- Defence (+53%), mainly due to the Eurofighter project and the radar contracts in Germany and Oman.

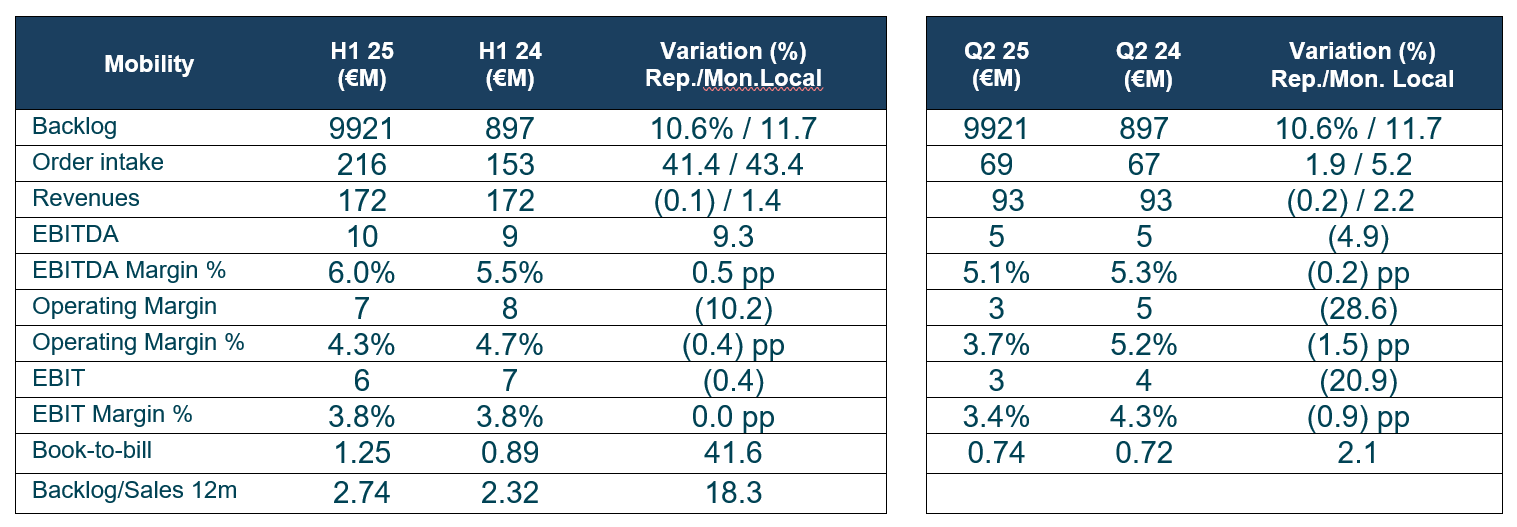

- Mobility (+41%), thanks to the contracts in Ireland and Colombia.

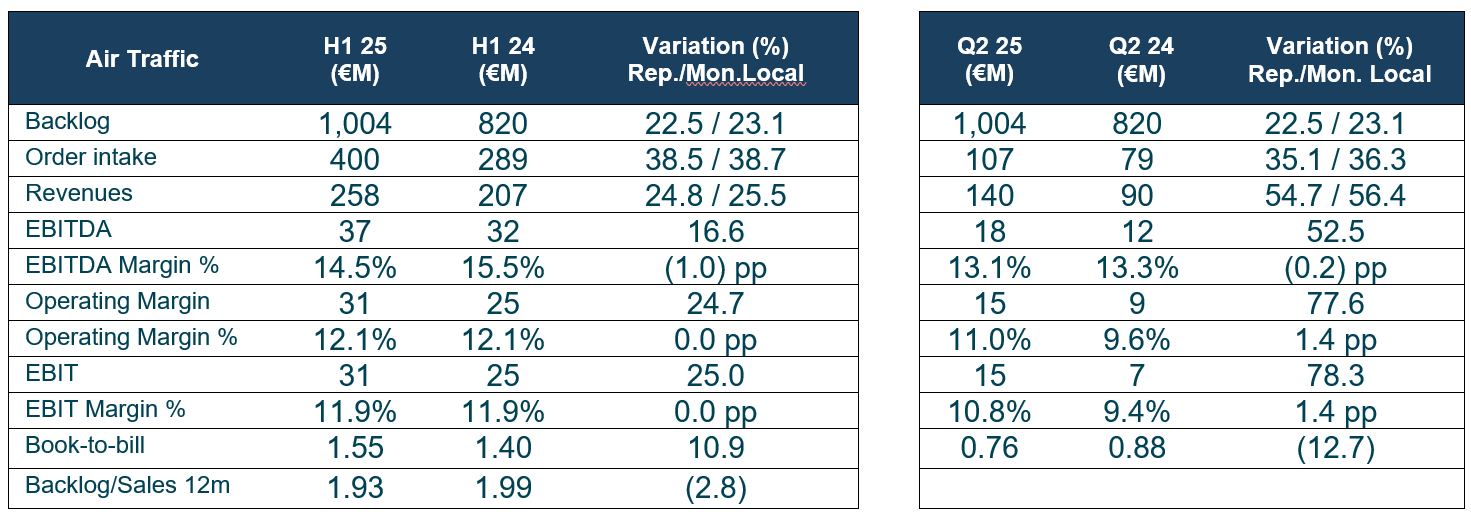

- Air Traffic, ATM (+38%), chiefly due to the contribution of the UK’s air navigation radars and the business in Spain.

A 6% increase in revenues

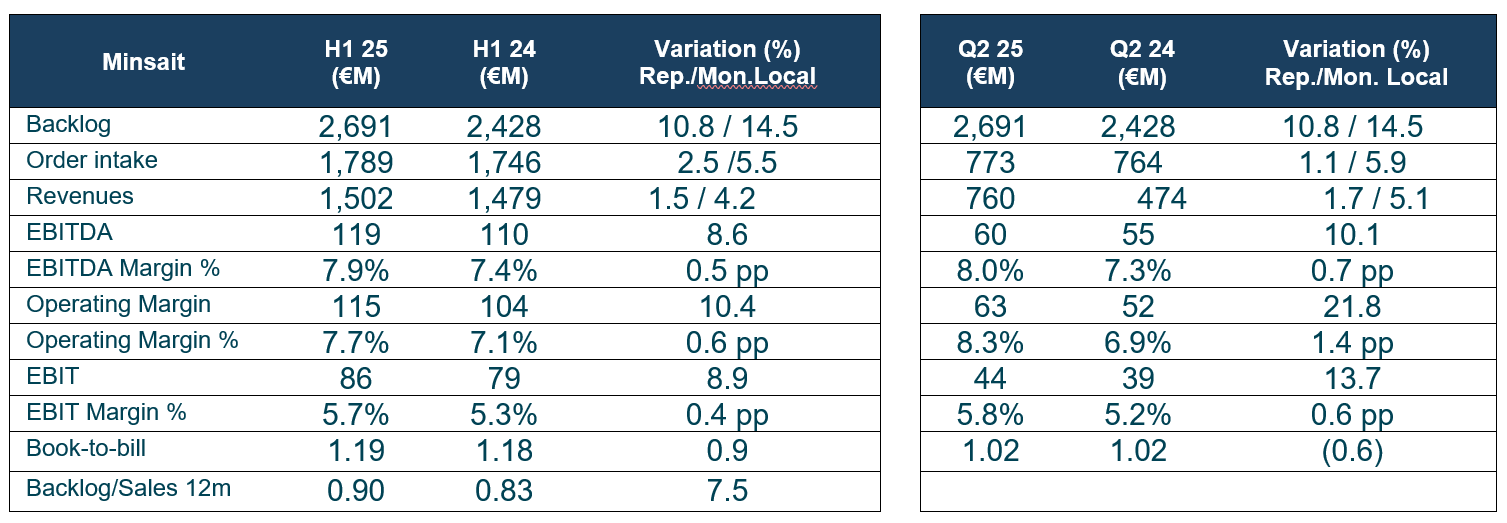

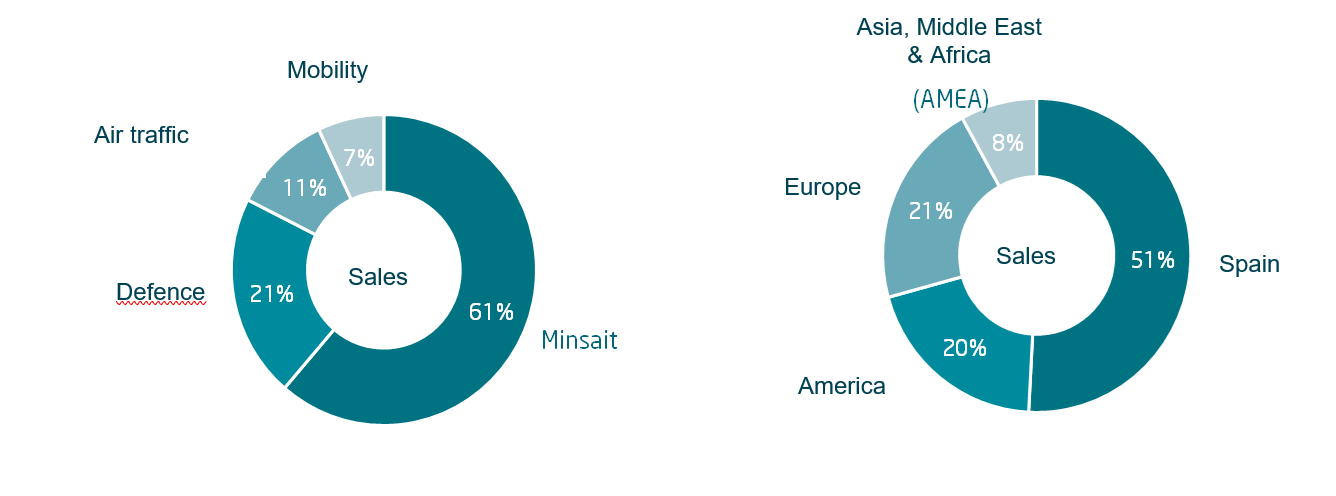

Revenues rose by 6% between January and June, with all of the divisions undergoing growth (ATM +25%, Defence +16% and Minsait +2%), except for Mobility, which remained stable. According to the data for the second quarter, revenues also increased across all of the divisions (ATM +55%, Defence +15% and Minsait +2%), except for Mobility, which remained stable.

The exchange rate subtracted €43 million (-1.9 percentage points) from the first-half revenues, mainly due to the depreciation of the dollar against the euro and its impact on the currencies in Brazil and Mexico.

Organic revenues in the first half of 2025 (excluding the inorganic contribution of acquisitions and the effect of the exchange rate) rose by 5%, with growth in ATM (+22%), Defence (+11%) and Minsait (+2%).

The international market accounted for 49% of sales in the period, with particularly significant 10% growth in Europe.

Improved operating profitability

The EBITDA margin stood at 10.8% in the first half of the year, compared to the figure of 10.0% in the same period of 2024 (a 15% increase in absolute terms). This improvement can mainly be put down to the greater growth in revenues recorded in the divisions with the greatest operating profitability (Defence and ATM), as well as the improved returns of Defence, Mobility and Minsait.

In quarterly terms, the EBITDA margin rose to 10.9% between April and June, set against the figure of 9.6% in the same period of 2024, constituting a 24% increase in absolute terms.

The Defence and ATM divisions accounted for more than half of the company’s EBITDA, thereby strengthening their growing weight in the business structure, in keeping with the objectives set out in the ‘Leading the Future’ Strategic Plan.

The operating margin in the first half of the year stood at 9.9% compared to 9.1% in the same period in 2024 (a 16% rise in absolute terms). Other operating income and expenses (the difference between the Operating Margin and the EBIT) in the first six months of the year amounted to -€33 million, set against -€31 million in the first half of 2024.

The EBIT margin rose to 8.6%, compared with the figure of 7.8% in the first half of 2024, with 17% growth in absolute terms. With respect to the data for the second quarter, the margin rose to 8.9% from the figure of 7.5% recorded in the same period of the previous year, growing 28% in absolute terms.

Growth in revenues due to the operational improvement and the impact of TESS

The Net Profit between January and June stood at €215 million compared to €114 million in the same period of 2024, constituting 88% growth as a result of the operational improvement and the one-off impact on the financial results stemming from the increase in the valuation of the stake in TESS Defence. Excluding this one-off impact, profit would have increased by 24%, reaching €138 million in the first semester.

The Net Debt stood at €4 million in June 2025, set against the positive Net Cash position totaling €86 million in December 2024 and the €89 million Net Debt recorded in June 2024.

The workforce grows by 3,542

The average workforce increased by 6% year-on-year in the first half of the year. The final workforce at the end of June 2025 was made up of 61,162 employees, constituting a 6% increase compared to the figure in June 2024. A total of 3,542 employees joined the company in the first six months of the year, with the increase chiefly focusing on Spain (2,618 more employees) and the Americas (672 more employees).

Forecasts for the new IndraMind division

The goal is for the IndraMind division to record €1 billion in revenues by 2030. This new business division will seek to create a benchmark platform for advanced artificial intelligence to consolidate the Group’s technological capabilities and leadership of AI, cybersecurity, and cyberdefence with a dual civil-military focus.

Key Highlights

Acquisitions contributed €72 million to sales in H1 25 vs €9 million in H1 24. The acquisitions of Totalnet and MQA contributed inorganically to Minsait, GTA, Deimos and CLUE contributed to Defence, and Micronav and Global ATS contributed to ATM.

Results by business units

Revenues by divisions and geographical areas

Goals for 2025*

- Revenues in local currency: greater than €5.2 billion

- Reported EBIT: greater than €490 million.

- Reported Free Cash Flow: greater than €300 million.

*Does not include the acquisitions of TESS Defence and Hispasat