- Revenue stood at €2,086 million, representing 3% growth in local currency terms

- Business in the Spanish market showed early signs of recovery, with positive growth rates in the third quarter standalone. All other regions remain in growth, particularly AMEA, expanding 13%

Indra's earnings performance in the first nine months of 2014 was shaped chiefly by: an incipient business recovery in the Spanish market (+2% in the third quarter standalone); a good performance from the AMEA region, with growth of 13% in local currency terms; and an adverse macroeconomic performance in Latin America (particularly Brazil), which saw growth in the region slow further. Currency depreciation had an impact, but to a lesser degree than in the first half of the year.

Total revenue stood at €2,086 million, representing 3% growth in local currency terms and a slight decline in the reported numbers (in euro) compared to the same period 2013.

By regions, YTD revenue figures are as follows: Spain (accounting for 38% of the total) posted a decline of 6%. However, the recent positive trend in the Spanish market, with two consecutive quarters of growth, is expected to continue into the final quarter of the year, as macroeconomic improvements in Spain and the euro area begin to take hold. The AMEA region recorded 13% growth in local currency terms (11% reported), which is a more than striking performance bearing in mind that several key projects came to an end in the first half; Europe and North America grew 7% in local currencies (6% reported); while Latin America registered 9% growth in local currency terms (down 5% reported).

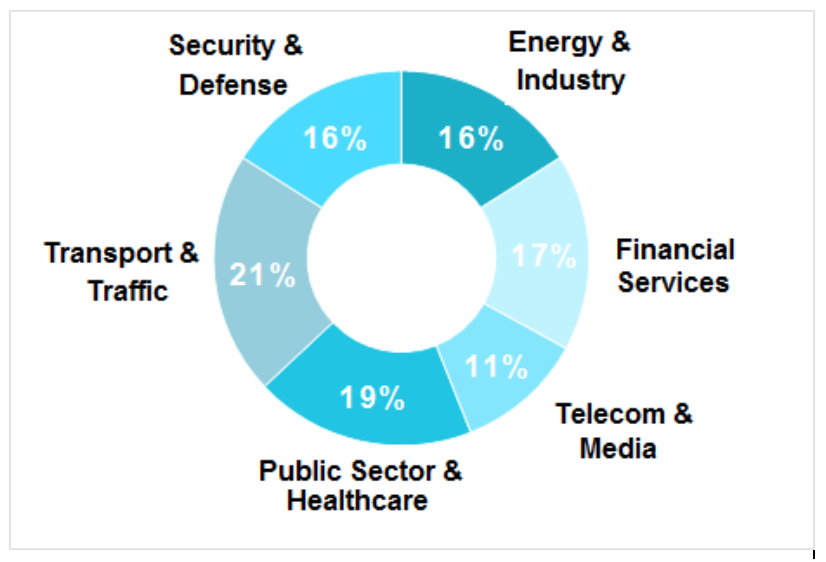

Looking at vertical markets in the local currency, Public Administrations & Healthcare posted growth of 12%, Transport & Traffic 9% and Financial Services 6%. Energy & Industry recorded a flat performance, while Security & Defense recorded a drop of 3%. Telecom & Media showed a decline of 9%, which reflects an improved performance this quarter compared to the first half of the year.

Net profit was up to €78 million, representing an 18% increment on the same period in 2013, largely thanks to lower extraordinary expenses.

Order intake stood at €2,126 million, 2% higher than revenue, which is in line with the ratio seen in the third quarter 2013. There was a particularly strong 43% uptick in order intake for the AMEA region. The figure in Spain held in positive territory.

The recurrent EBIT margin stood at 7.5%. Indra made further progress in its efficiency and resource optimization plan for Spain during the third quarter, incurring a total of €16 million in extraordinary costs, which includes the bulk of investments programmed for 2014.

2014 earnings forecast

The final quarter is usually when the bulk of free cash flow is generated, and this is set to be the case again this year.

Achievement of the full-year 2014 free cash flow generation target of over €100 million includes billing and receivables for certain projects in Mexico and Brazil, as well as receivables linked to other significant contracts awarded in the final stages of the year and that are still being finalized.

KEY FINANCIAL FIGURES

The table below shows the key financial figures for the period:

|

|

9M14 (€M) |

9M13 |

(Variation%) Reported / Local Currency |

|

Order intake |

2,126 |

2,177 |

(2) / 3 |

|

Revenues |

2,086 |

2,123 |

(2) / 3 |

|

Backlog |

3,436 |

3,448 |

(0) |

|

Recurrent Operating Profit (EBIT)(1) |

156 |

167 |

(7) |

|

Recurrent EBIT margIn (1) |

7.5% |

7.9% |

(0.4) pp |

| Extraordinary cost |

(16) |

(27) |

(41) |

|

Net Operating Profit (EBIT) |

140 |

140 |

0 |

|

EBIT margin |

6.7% |

6.6% |

0.1 pp |

|

Recurrent Net Profit (1) |

91 |

87 |

4 |

|

Neto Profit |

78 |

67 |

18 |

|

Debt net position |

726 |

707 |

3 |

|

Free cash flow |

-5 |

0(2) |

-- |

(1) Before extraordinary items

(2) FCF adjusted for the disposal of the advanced digital document management arm, -€24 million