- The net order intake increases by 20% and revenues grow by 6%, with double-digit year-on-year increases in ATM and Defence

- EBITDA and EBIT post 10% year-on-year increases, with improvement in both margins

- Net profit rises to 291 million euros between January and September, 58% higher than the figure recorded in the same period of 2024

- The company begins the last quarter of the year in a historic position, reaffirming all of the financial goals for 2025

- The purchase of the El Tallerón plant in Gijón and the acquisition of Aertec are announced during the third quarter

- Following the award of the funding for the Special Modernization Programs (SMPs), the Defence portfolio is expected to exceed 10 billion euros in 2026

- The company announces a Capital Markets Day in the second quarter of 2026 to present, one year ahead of schedule, the second phase of the Leading the Future-Scale Up Strategic Plan

Indra Group executive chairman Ángel Escribano highlighted “the stability of our results and our clear undertaking to anticipate the needs of the defence sector, which has already been reflected in a 7% increase in our workforce in Spain. We’re consolidating a plan for the company and the country that’s capable of addressing challenges, mobilizing industry and the national technological sector, and adding talent to sectors vital to our security”.

Indra Group’s CEO, José Vicente de los Mozos, pointed to “the progress of all of the business units, especially aerospace and defence. Furthermore, the acceleration of our industrial plan, with the expansion of our productive and technological footprint, is preparing us to lead the delivery of the special modernization programs, for which we’re mobilizing the entire national industrial ecosystem. This is being achieved thanks to the commitment and motivation of the people who work for the company on a daily basis”.

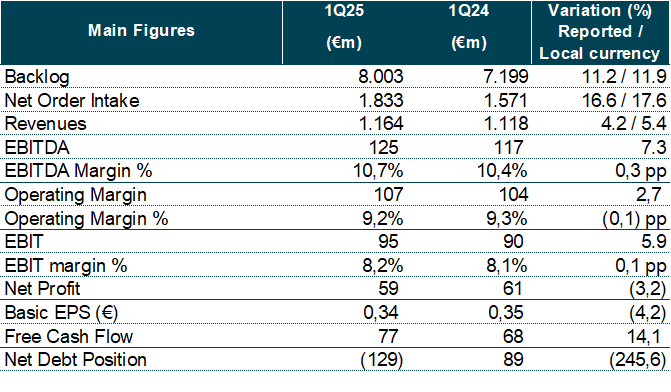

Main features

Indra Group posted profits amounting to 291 million euros between January and September 2025, 58% higher than the figure recorded in the same period of the previous year. The result was driven by the high order intake and revenue growth in all of the businesses, particularly Air Traffic Management (ATM) and Defence, the two most profitable divisions. The net profit included the one-off financial income resulting from the increase in the stake in TESS. If this extraordinary effect is excluded, the result amounted to 216 million euros, an increase of 17% compared with the first nine months of the previous year.

The net order intake increased by 20% in the first nine months of the year, with an outstanding performance in all of the business divisions.

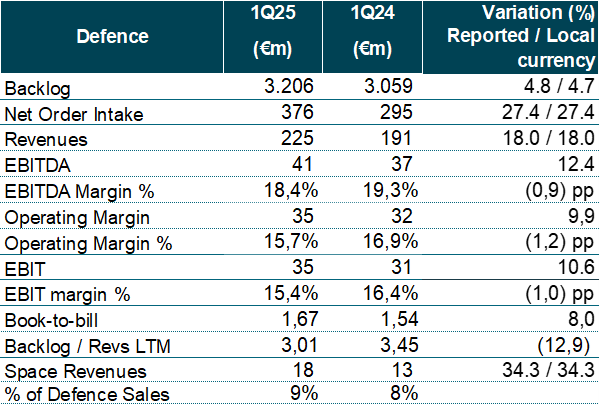

• Defence (+47%). The figure stood at 1.018 billion euros, mainly due to the Eurofighter project, the S-80 submarine modernization contracts for the Spanish Navy and the radar contracts in Germany and Oman.

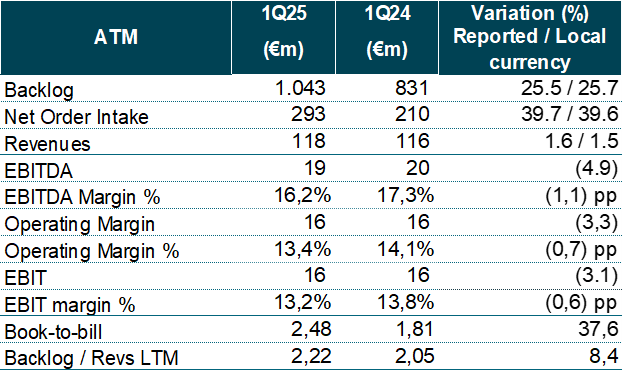

• ATM (+57%). Air traffic recorded double-digit growth in all of the regions, due in particular to the radio renewal contract in the United States and the radar contract in the United Kingdom.

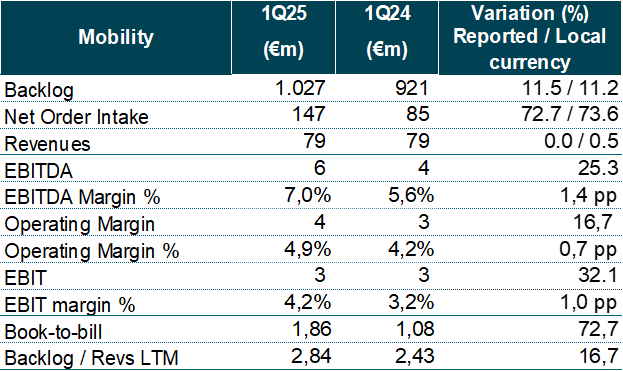

• Mobility (+10). The railroad projects in Chile and Romania and the toll systems in Colombia accounted for most of the progress.

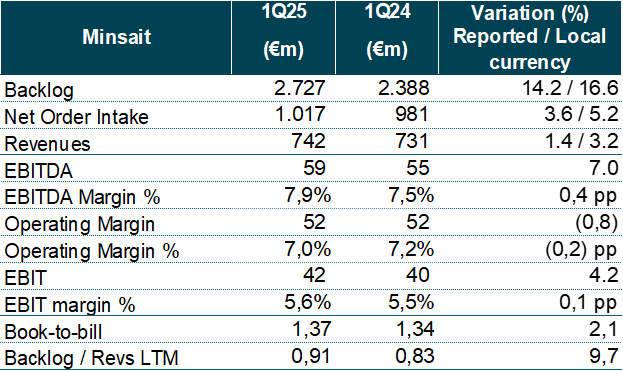

• Minsait (+7%). Double-digit growth in the Public Authorities, Healthcare, Energy and Industry.

Between January and September 2025, revenues consolidated their progress with a 6% year-on-year rise, growing in all of the business divisions, particularly Defence (up 14%) and ATM (up 16%).

The positive turnover figures were spread across all of the regions in which the company operates, with Europe posting an 11% increase in revenues in the period to September, followed by Asia, the Middle East and Africa (AMEA), where sales grew by 6%.

All of the profitability indicators improved with respect to the 2024 period. If we compare only the third quarter of the year, there was a one-off drop in the margins due to the higher operating expenses in Defence. These expenses were linked to the increase in the company’s capabilities with a view to the Special Modernization Plans (SMPs). They were also a reflection of Indra Group’s strategic undertaking to expand its industrial footprint as quickly as possible so as to meet the urgent needs of the Spanish and European defence sectors.

At the end of September, the workforce numbered 61,475, a 5% increase. This growth was mainly accounted for by Spain, where the number of employees grew even more (by 7%). There are now over 36,000 people on the payroll in the country.

Major events in the third quarter

The major events in the quarter included the acquisition of the Duro Felguera plant in Gijón (El Tallerón). The agreement provides for the integration of the facilities’ 156 staff with the aim of transforming the facility into one of the most modern military vehicle and tank factories in Europe.

In August, in keeping with the aims of increasing capacity and production, the Board of Directors unanimously agreed to appoint Frank Torres as the managing director of Indra Land Vehicles and Indra Group’s Chief Program Officer.

The company also reinforced its positioning in the unmanned aerial systems market with the acquisition of Aertec Defence & Aerial Systems (DAS) in July.

In the same month, Indra Group secured 385 million euros in financing from the European Investment Bank (EIB) to drive the company’s research and development activities in the Defence and Space sectors. This was the largest loan ever granted to a Spanish company in the sector by the EIB.

Acquisitions contributed €115M to sales in 9M25 vs €17M in 9M24. The acquisitions of Totalnet and MQA contributed inorganically to Minsait, GTA, Deimos, CLUE, TESS Defence and AERTEC contributed to Defence, and Micronav and Global ATS contributed to ATM.

Results by business units

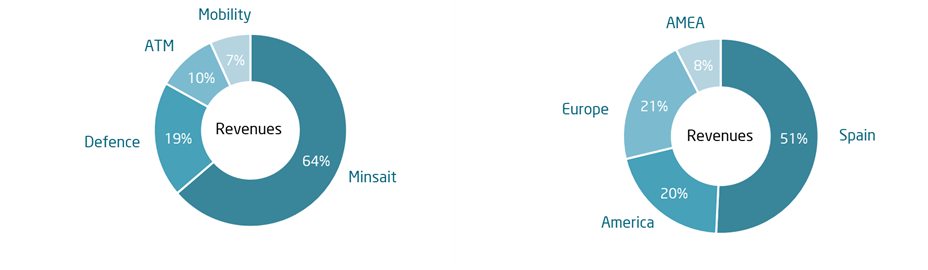

Breakdown of sales and EBITDA by business units

Revenues by geographical regions

Revenues by geographical regions rose in the Americas (+13%; 20% of total sales), Europe (+11%; 21% of total sales), AMEA (+7%; 9% of sales) and Spain (+5%; 50% of sales).

Goals in 2025

- Revenues in local currency: greater than €5.2 billion.

- EBIT reportado: superior a 490 M€.

- Reported Free Cash Flow: greater than €300 million.

*Does not include the acquisitions of TESS Defence and Hispasat